| In anticipation of Predictive Analytics World for Business in Chicago, PAW founder Eric Siegel interviewed speaker Richard Boire, Founding Partner at Boire Filler Group, who will be presenting The Holy Grail of Improving Modeling Performance (Math or Data). View the Q-and-A below to see how this PAW speaker has explored various mathematical techniques while striving to improve the lift of predictive models. |

| INTERVIEW WITH RICHARD BOIRE (BY ERIC SIEGEL) |

Q: In your work with predictive analytics, what behavior do your models predict?

A: Before even building a predictive analytics solution, we work with the business stakeholders to identify the exact business problem or challenge. Once this has been identified, we then determine the behaviors that need to be optimized or minimized to solve the challenge/problem. Our experience and breadth of work has resulted in the following type of model being built:

- Acquisition

- Upsell

- Cross-sell

- Attrition

- Fraud

- Credit risk

- Claim risk

Q: How does predictive analytics deliver value at your organization? What is one specific way in which it actively drives decisions?

A: In building marketing response type models, the ROI is significantly improved as lower costs are achieved to attain the same level of revenue that would otherwise be attained without modelling.

Marketing decisions can then be made on which customers to select based on their ROI.

In building automobile claim risk predictive analytics solutions, we are predicting the loss cost of a given vehicle. By integrating this information with premium, we can then determine which vehicles are overpriced vs. those which are underpriced.

Q: Can you describe a successful result, such as the predictive lift of your model or the ROI of an analytics initiative?

Listed below is the case of a property risk model that we built for an insurance company.

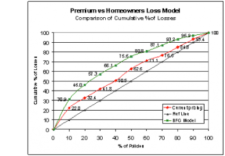

The green line represents our predicted analytics solutions while the red line represents the current premium pricing practice of the insurance company. The company's current pricing practices are delivering value as seen by observing the area under the curve between the red line and the straight line. Yet, predictive analytics solutions built by our company are delivering even further value as depicted by the area under the curve between the green line and the red line.

Q: What surprising discovery have you unearthed in your data?

A: In some cases, we have been able to use the data to identify a major change in someone's life. A good example of this is identifying an individual that has just moved by observing that the address data has now changed for that individual. The ability to identify movers vs. non movers has led marketers to develop unique communication strategies towards this segment.

Another good example is tenure. We often find that customer behavior is often U-shaped with this variable which implies that newer and longer-tenured customers tend to be loyal, while the middle group or more average tenure type customers tend to be less loyal.

| LEARN MORE ABOUT RICHARD BOIRE & PAW BUSINESS |

Check out the entire interview on the Predictive Analytics Times. Read Richard Boire’s book, Data Mining for Managers: How to use Data (Big and Small) to Solve Business Challenges.

Gain insight, applicable takeaways, and inspiration from Richard Boire in person by attending his presentation at PAW Business Chicago. Sign up now to attend the conference and enjoy the early bird rate of up to $400 off.

PAW Business Chicago is co-located with PAW Manufacturing, the eMetrics Summit, and the Predictive Analytics Times Executive Breakfast.

This email was sent by: Rising Media Inc.

211 E. Victoria Street, Suite E, Santa Barbara, CA 93101 |

|

Produced by:

|

|